A new biography of real-estate magnate Albert M. Greenfield paints a subtle portrait, and asks some penetrating questions.

By Dan Rottenberg C’64

Temple University Press, 2014, $35.

By Dennis Drabelle | Dan Rottenberg opens and closes his nuanced, judicious account of the life and times of a prominent Philadelphian with an historical vignette. On a December evening in 1930, representatives of the Philadelphia banking establishment convened in a Merion mansion to decide the fate of Albert M. Greenfield and his Bankers Trust Company, the city’s tenth-largest bank. The bank had been beset by a run: depositors had lost confidence and wanted to withdraw their money. Bankers Trust had already paid out $17 million, which was all it had, or could raise on its own, in cash. Though not present at the meeting, Greenfield had assured the Main Line grandees that his bank was sound enough to be saved by a bailout.

More was at stake than just one institution. Bank runs could be contagious, and whether this one would infect other banks was anyone’s guess. The meeting was trending in Greenfield’s favor until, as Rottenberg describes it, “a single voice pierced the stale air in the drawing-room.” The speaker accused Greenfield of flouting what Rottenberg calls “Philadelphia tradition,” and hence he was not to be trusted. These objections carried the day. No bailout. No more Bankers Trust. A humbled, if not quite ruined, Albert M. Greenfield. Ever after, he attributed the rejection to anti-Semitism—a charge that Rottenberg will return to at the end of the book.

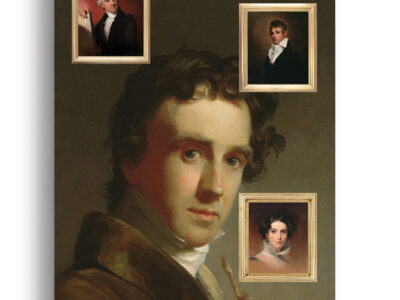

Avrum Moishe Grunfeld was born in what is now Ukraine, in 1887. When he was nine, the Grunfelds emigrated to New York. Soon afterward, they moved to Philadelphia, the city that Albert Monroe Greenfield, as he restyled himself, came to love. For the most part, it loved him back. He enrolled in Penn Law School (at the tender age of 15—and without even a high-school diploma!) but dropped out because his business skills—intelligence, vision, immense self-confidence, and a genius for making and cultivating contacts—had already surfaced. After trying several other lines, he became a real-estate broker and financier. By the 1920s, he was not only doing more real-estate deals than anyone else in town but was also amassing a small empire, including stores, hotels, and that bank. His biggest coup was to win over Dennis Dougherty, the cardinal-archbishop of Philadelphia, who steered much of the growing archdiocese’s business to Greenfield and wangled him a papal knighthood.

But in racking up these successes—and here’s the rub that Rottenberg introduces gradually and carefully—Greenfield departed from prevailing ethical standards in various ways, including influence-peddling and the kind of frenzied asset-churning that lends itself to pyramid schemes. The irrational exuberance of the Roaring Twenties gave him an added boost, and at a time when the Pennsylvania Railroad, one of the country’s most powerful and respected corporations, had to offer a 7 percent return on its earnings to sell a new stock issue to the public, “the stock offering for Bankers Securities [a 1928 spinoff from Bankers Trust]—a company with no product, no customers, and no track record—had been oversubscribed while promising only 5 percent.”

After the failure of Bankers Trust, Greenfield made a comeback as a merchant prince. Rich again, he became a philanthropist; among the beneficiaries was Penn, where he endowed the Albert M. Greenfield Center for Human Relations. Though not much interested in practicing his faith, he was an ardent Zionist whose ghostwriting of a presidential statement about the new state of Israel may have helped his friend Harry Truman win the presidency in his own right in 1948. In old age, Greenfield contributed his brainpower and his address book to the renaissance of Center City. He died in 1967, at the age of 79.

Rottenberg evinces mixed feelings about both Greenfield and those WASP bankers who may or may not have been motivated by ethnic prejudice when they voted to hang Bankers Trust out to dry. In his epilogue, Rottenberg asks the reader to imagine herself present, as a voting member, at the 1930 meeting in Merion—but with the benefit of hindsight. “You know that, beginning in the 1980s, the stodgy bankers in that room … will be succeeded by a new breed of creative financiers, very much in the mold of Albert Greenfield, who will devise financial devices of such ingenious complexity that the entire banking community will lose sight of the basic principles of risk evaluation, causing the collapse of America’s housing market as well as a global stock-market crash in 2008. You know that such calamities might have been avoided had bankers been a little less brilliant and a little more boring.”

Rottenberg is suggesting, in other words, that Philadelphia’s elite bankers may have had good reason to sacrifice Greenfield regardless of any anti-Semitism they harbored, because they adhered to old-fashioned but not outmoded notions of how banking should be conducted. It’s a provocative coda to a terrific book, one that anyone with an interest in Philadelphia history, American Jews, American WASPS, or the annals of American business should read.

Dennis Drabelle is a contributing editor of The Washington Post Book World.