Not many people came out of the global financial crisis richer, and even fewer did so without arousing deep suspicion. Nassim Taleb WG’83 belongs to an even rarer class. The options trader turned philosopher-mathematician pulled off both feats soon after writing a bestselling book that laid out the rationale for both accomplishments. The Black Swan: The Impact of the Highly Improbable, named by The Times of London as “one of the 12 most influential books since World War II,” examined the role of unpredictable and highly consequential events in history, engineering, science, and—most famously—finance.

In April, Taleb returned to Wharton to deliver the annual Goldstone Forum lecture, endowed by Steven F. Goldstone C’67. He focused on the concepts of fragility, robustness, and “anti-fragility,” a concept he coined to describe systems that actually benefit from unpredictable shocks. Toward the end of a talk that occasionally veered into technical terrain, Taleb sung the virtues of an investment strategy you’re unlikely to hear from a typical portfolio manager: parking your wealth in cash. (See the complete video of Taleb’s lecture.)

People kept telling me I was an idiot for years [because] I didn’t invest in markets.

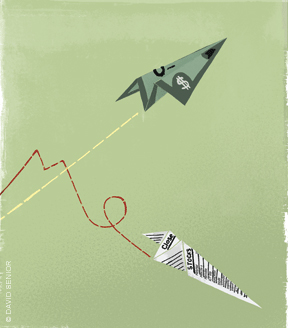

I don’t invest in the stock market because I think it’s a sucker’s game. I make my money and I put it in a repository [of value]. Or sometimes I just do these bets for entertainment, nothing else, so I can have a conversation with someone once in a while on a train or on a plane. That’s the only reason. So I stayed in cash, for years, and then realized that the value of my cash became monstrously high after the crisis. The last 12 years, the stock market did nothing, and cash yielded 40, 50, 60 percent.

Cash gives you an option when other people go bust. That’s what Kennedy did. Joe Kennedy, the father, got rich not from investments but from negative investments. In other words, he had no investment when other people were busted. [Take] the story of the two brothers [one of whom makes $4 per share a year while carrying no insurance against being wiped out, one of whom makes $2 per share with maximal insurance]. If the $2 brother can survive—without being kicked out by the board and replaced with some short-volatility fellow who doesn’t understand anti-fragility—then when the other brother goes bust, he’ll be able more aggressively to buy his inventory—his refrigerator, his car, everything, even his house—for nothing. You see the idea? So you have to think in terms of dynamics of cash: that it’s not a sissy trade.

There’s something called action bias. People think that doing something is necessary. Like in medicine and a lot of places. Like every time I have an MBA—except those from Wharton, because they know what’s going on!—they tell me, “Give me something actionable.” And when I was telling them, “Don’t sell out-of-the-money options,” when I give them negative advice, they don’t think it’s actionable. So they say, “Tell me what to do.” All these guys are bust. They don’t understand: you live long by not dying, you win in chess by not losing—by letting the other person lose. So negative investment is not a sissy strategy. It is an active one.